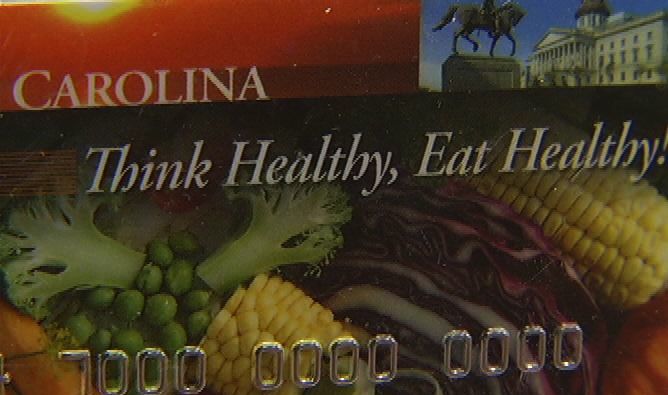

The program also offers these benefits to homeless people. Supplemental Nutrition Assistance Program (SNAP) provides Food Stamps to families as well individuals living in South Carolina. Since most low-income households can't afford diet needed for healthy growth, SNAP comes in to help. Adults will be more productive at work while improving their job skills and living a healthy life. The program gives an opportunity to kids to perform better at school. The program assists eligible households so that they can buy nutrition food that will help in growth and healthy development of children. The facts are the same as example A, but with federally administered State supplementation.South Carolina SNAP, formerly known as Food Stamps, provides financial aid to low-income families so that they can meet their food requirements. = $232 divided by 1/2 =$116 (Countable income)ĮXAMPLE C – SSI Federal Benefit and STATE SUPPLEMENT with only UNEARNED INCOME Total monthly income = $317 (Gross wages) =$561 (SSI Federal benefit) EXAMPLE B – SSI Federal Benefit with only EARNED INCOME Total monthly income = $300 (Social Security benefit) = Your SSI Federal benefit THE FOLLOWING EXAMPLES ARE BASED ON SAMPLE DOLLAR AMOUNTS: EXAMPLE A – SSI Federal Benefit with only UNEARNED INCOME The result is your monthly SSI Federal benefit as follows: Step 2: We subtract your "countable income" from the SSI Federal benefit rate. The remaining amount is your " countable income". Step 1: We subtract any income that we do not count from your total gross income. Refundable Federal and advanced tax credits received on or after JanuandĬertain exclusions on Indian trust fund payments paid to American Indians who are members of a federally recognized tribe HOW DOES YOUR INCOME AFFECT YOUR SSI BENEFIT? The first $2,000 of compensation received per calendar year for participating in certain clinical trials See the SSI Spotlight on Special SSI Rule for Blind People Who Work The cost of work expenses that a blind person incurs in order to work. See the SSI Spotlight on Impairment–Related Work Expenses The cost of impairment–related work expenses for items or services that a disabled person needs in order to work. See the SSI Spotlight on Student Earned Income Exclusion See the SSI Spotlight on Plan to Achieve Self–Support Įarnings up to $2,040 per month to a maximum of $8,230 per year (effective January 2022) for a student under age 22. Income set aside under a Plan to Achieve Self-Support (PASS).

Money someone else spends to pay your expenses for items other than food or shelter (for example, someone pays your telephone or medical bills) Loans to you (cash or in–kind) that you have to repay Grants, scholarships, fellowships or gifts used for tuition and educational expenses įood or shelter based on need provided by nonprofit agencies Interest or dividends earned on countable resources or resources excluded under other Federal laws Small amounts of income received irregularly or infrequently The value of Supplemental Nutrition Assistance Program (food stamps) received Īssistance based on need funded by a State or local government, or an Indian tribe The first $65 of earnings and one–half of earnings over $65 received in a month The first $20 of most income received in a month WHAT INCOME DOES NOT COUNT FOR SSI?Įxamples of payments or services we do not count as income for the SSI program include but are not limited to: Some of your income may not count as income for the SSI program. If your countable income is over the allowable limit, you cannot receive SSI benefits. Generally, the more countable income you have, the less your SSI benefit will be. WHY IS INCOME IMPORTANT IN THE SSI PROGRAM?

Sc food stamps for free#

In-Kind Income is food, shelter, or both that you get for free or for less than its fair market value.

Unearned Income is all income that is not earned such as Social Security benefits, pensions, State disability payments, unemployment benefits, interest income, dividends and cash from friends and relatives.Earned Income is wages, net earnings from self–employment, certain royalties, honoraria, and sheltered workshop payments.Income includes, for the purposes of SSI, the receipt of any item which can be applied, either directly or by sale or conversion, to meet basic needs of food or shelter. Income is any item an individual receives in cash or in-kind that can be used to meet his or her need for food or shelter. Understanding SSI Home Page / Understanding Supplemental Security Income SSI Income SUPPLEMENTAL SECURITY INCOME (SSI) INCOME

0 kommentar(er)

0 kommentar(er)